inheritance tax rate in michigan

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The state of Michigan levies no inheritance tax or estate tax as of 2015 reports the Michigan Department of Treasury.

Michigan Inheritance Tax Explained Rochester Law Center

Only a handful of states still impose inheritance taxes.

. The top estate tax rate is 16 percent exemption threshold. Other taxes could apply While inheritance taxes could potentially be a risk your estate faces they are far from the only. Michigan does not have an inheritance tax.

No estate tax or inheritance tax. The Michigan inheritance tax was eliminated in 1993. It only applies to older cases.

Michigan does have an inheritance tax. Few states levy inheritance or estate taxes. Only a handful of states still impose inheritance taxes.

Inheritance tax is levied by state law on an heirs right to receive property from an estate. How much can you inherit without paying taxes in Michigan. The estate includes cash on hand bank accounts financial assets stocks bond mutual funds etc real estate automobiles boats art pieces or rare collections personal.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. The top estate tax rate is 16 percent exemption threshold. Inheritance Estate Law in Michigan.

If there was a valid will the entire estate property passes as specified in the terms of that will. According to DGKT Accountants here are the three tiers for the most recent. A copy of all inheritance tax orders on file with the Probate Court.

However it does not apply to any recent estate. Ad Inheritance and Estate Planning Guidance With Simple Pricing. After much uncertainty Congress stabilized the Federal Estate Tax also known as the death tax.

Anything over that amount is taxed at 40. Connecticuts estate tax will have a flat rate of 12 percent by 2023. The lifetime transfer exemption for married couples is 2316 million for 2020.

Married people get to double the exemption. How much or if youll pay depends upon where the annuity came from and how much its worth. Michigan Taxes on Annuities.

Where do I mail the information related to Michigan Inheritance Tax. Thus the maximum Federal tax rate on gains on the sale of inherited property is15 5 if the gain would otherwise be taxed in the 10 or 15 regular tax brackets. In Michigan different laws apply depending on whether the deceased left a valid will.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost loved one. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

You may think that Michigan doesnt have an inheritance tax. You will pay 000 in taxes on the first 1170000000. Per the American Taxpayer Relief Act of 2013 only the richest estates pay federal estate taxes states Nolo.

According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. This increases to 3 million in 2020 Mississippi.

If you have questions about either the estate tax or inheritance tax call 517 636-4486. However personal representatives who are administering decedents estates are still required to file a final MI-1040 return for the decedent and still required. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect.

Inheritance taxes are levied by the states. Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. For 2019 the lifetime transfer exemption for individuals was 114 million based on the value of the estate at the time of death.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. No estate tax or inheritance tax. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier.

Set at 5 million in 2012 the federal estate tax exemption adjusts. The Michigan inheritance tax was eliminated in 1993. Is there a contact phone number I can call.

As of this writing Michigan no longer collects estate taxes and only collects inheritance taxes if legacies are received from a person that died on or before September 30 th 1993. Michigans estate tax is not operative as a result of changes in federal law. No estate tax or inheritance tax.

This means that in many cases an estate is taxed twice -- first by the federal estate tax then by the state inheritance tax. An inheritance tax return must be filed for the estates of any person who died before October 1 1993. As of 2021 you can inherit up to 1170000000 tax free.

In 2022 Connecticut estate taxes will range from 116 to 12 with a. Some states also tax beneficiary inheritances based on your residence status and your relationship to the deceased. Surviving spouses are always exempt.

The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. Although Michigan does not impose a separate inheritance or estate ta x on heirs you may have to pay state taxes on your annuity income. Only in very rare cases would this.

Estate laws set out rules and procedures for the disposition of property owned by someone who dies. Federal Death Tax. However as the exemption increases the minimum tax rate also increases.

State inheritance tax rates range from 1 up to 16. Lansing MI 48922. Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023.

Most estates from 1993 and before have already been settled and the taxes have been taken care of. The exemption increased to 1158 million for 2020.

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

Michigan Inheritance Laws What You Should Know

Why Canada Has Just About The Worst House Price Bubble In The World House Prices Canada World

Examples Of Expansionary Monetary Policies Monetary Policy Financial Literacy Loan Money

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Corporate Income Tax Definition Taxedu Tax Foundation

Inheritance Tax Here S Who Pays And In Which States Bankrate

Taxes The Treasurer Village Of Pinckney

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

Have You Maximized Your Contribution Contribution Tax Brackets End Of Year

2022 Property Taxes By State Report Propertyshark

Michigan Estate Tax Everything You Need To Know Smartasset

States With Highest And Lowest Sales Tax Rates

States With No Estate Tax Or Inheritance Tax Plan Where You Die

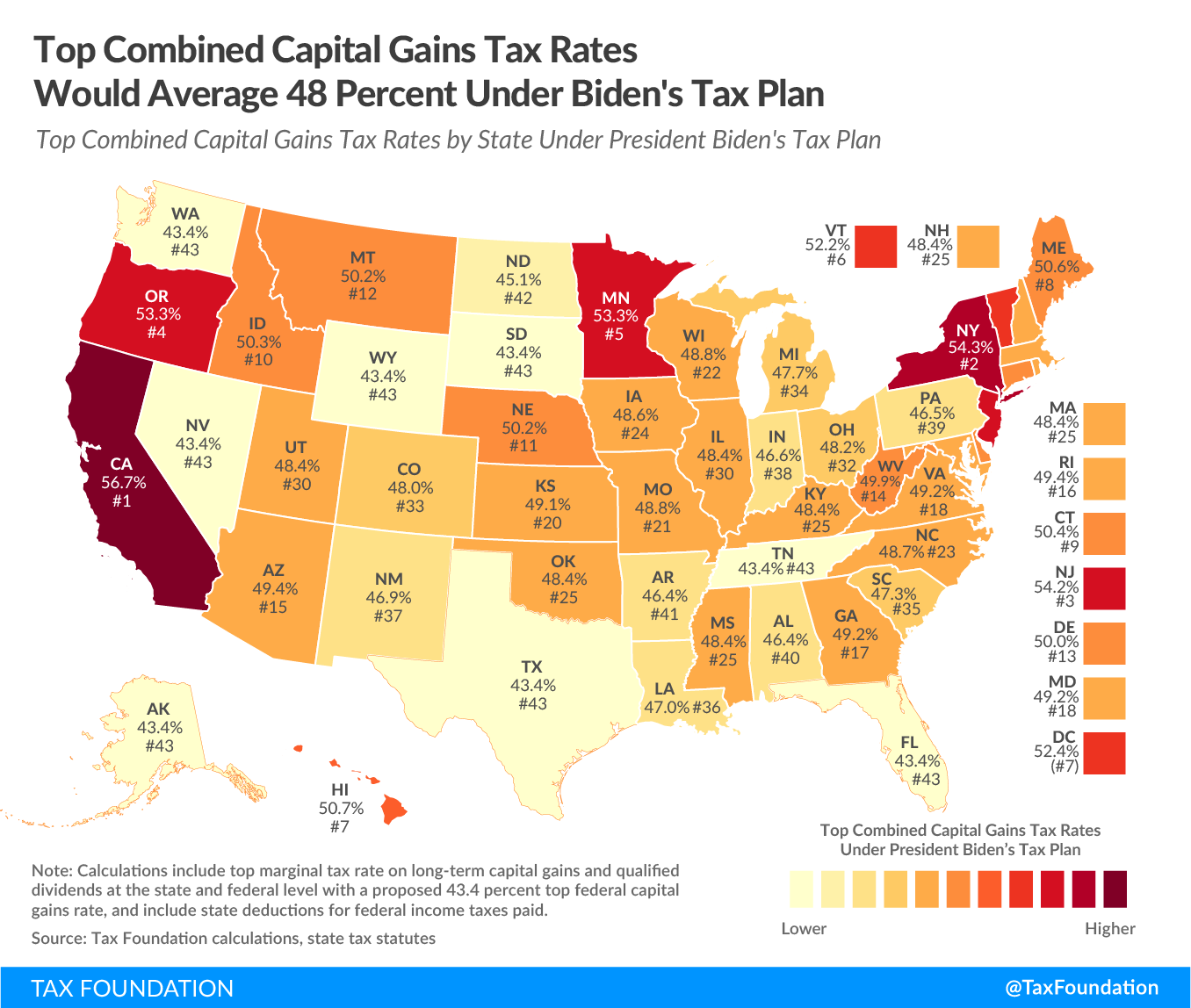

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

Roth Ira Traditional Ira Contribution Limits For 2021 And 2022 Tax Brackets Standard Deduction Irs