tax payment forgiveness program

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married.

Back Tax Blog Keith Jones Cpa Trusted Tax Relief Company

You need to prove to the IRS.

. An Installment Agreement is a tax forgiveness program that allows you to repay your debts with a schedule. In Indiana for example the state tax rate is 323. One IRS tax forgiveness program also known as an offer in compromise comes with a long list of benefits.

Agree to a direct payment installment forgiveness Earn less than 100001 200001 for joint taxpayers Owe less than 50000 at the time of application. Your tax balance needs to be below 50000 for you to be able to qualify for a tax forgiveness program. States also offer tax forgiveness based on personal income standards.

Although its rare for the IRS to fully forgive your tax balance it does offer various ways to reduce or eliminate some of your tax debt. The program offers tools and assistance. 855-598-4280 IRS Tax Debt Forgiveness Program Wondering if tax forgiveness is real.

Provides a reduction in tax liability and. The OIC or Deal in Compromise is just one of the manner ins which the internal revenue service has created as a means to collect on the amount. For example in Pennsylvania a single person who makes.

Child Tax Credit The 2021 Child Tax Credit is up to 3600 for each qualifying child. If you cannot remit the entire amount due to various issues and owe a debt of less. This includes penalty abatement Innocent Spouse Relief.

22 hours agoANCHOR is for residents of New Jersey who owned or rented their primary residence on October 1 2019 and who meet the following income guidelines. Form 656 s you must submit individual and business tax debt Corporation LLC Partnership on separate Forms 656 205 application fee non-refundable Initial payment. Some of the biggest perks include.

Furthermore you cant have more than 100000 in income if you are filing alone and. Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the credit. Generally if you borrow money from a commercial lender and the.

2 the nonprofit news website Mississippi Today reported state residents who were eligible for up to 10000 in student loan forgiveness will see 500 in additional. First Time Penalty Abate and Administrative Waiver Reasonable Cause Statutory. October 25 2022 by Olivia Austin.

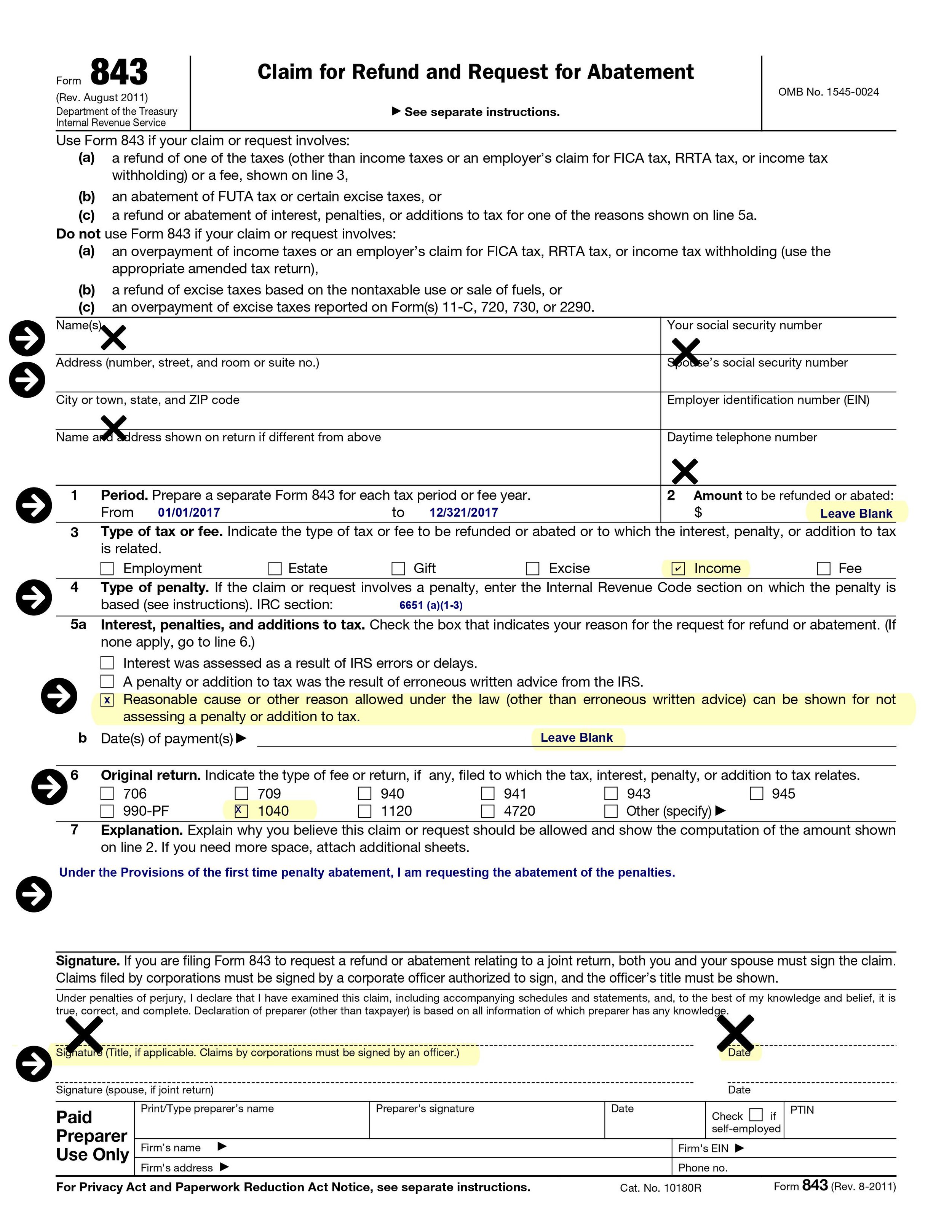

The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. You may be given one of the following types of penalty relief depending on the penalty. The IRS debt forgiveness program is a way for taxpayers who owe money to the IRS to repay their debts in a more manageable way.

IRS debt forgiveness is for those with a debt of 50000 or less. IRS Tax Forgiveness Program. If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate.

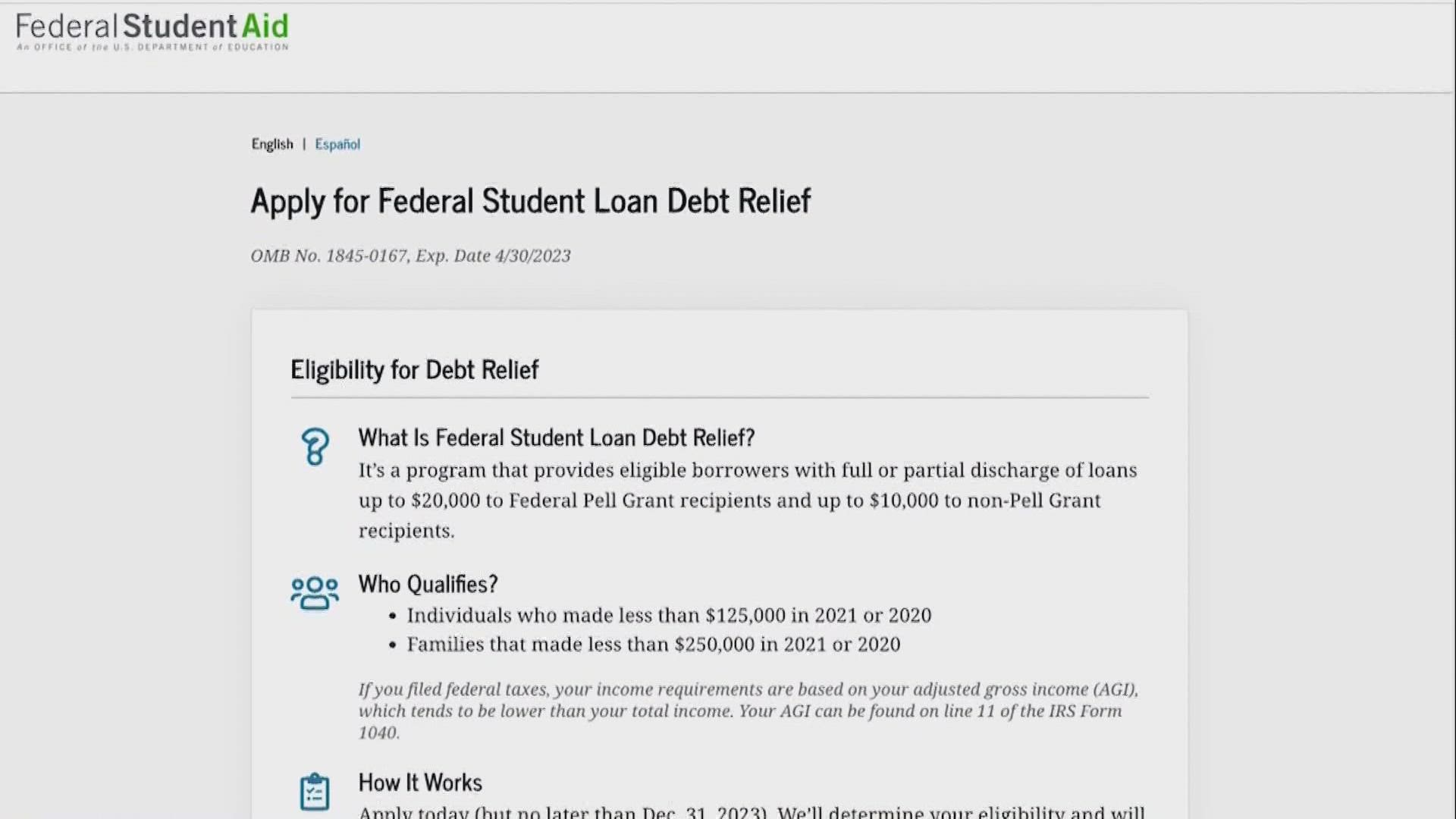

You qualify to have up to 10000 forgiven if your loan is held by the Department of Education and you make less than 125000 individually or 250000 for a family. To be eligible for the IRS Tax Forgiveness Program you must owe the IRS at least 10000 in back taxes. If you pursue certain payment.

These standards vary from state to state.

Tax Free Student Loan Forgiveness Is Part Of The Latest Covid 19 Relief Bill Hbla

Which States Tax Student Loan Forgiveness And Why Is It So Complicated Tax Policy Center

Student Loans Who Can Pay Taxes On Forgiven Debt Marca

Milford Tax Penalty Forgiveness Program Bryan Shupe

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

What Student Loan Forgiveness Means For You Vox

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Minnesota Legislators Are Considering Lifting Taxes On Federal Student Debt Relief

Who Benefits From Student Debt Cancellation

Tax Relief Questions And Answers Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How Do You Qualify For Irs Debt Forgiveness Ideal Tax

Tax Won T Go Up 2 100 To Pay For Biden Student Loan Forgiveness Verifythis Com

Judge Dismisses Effort To Halt Student Loan Forgiveness Firstcoastnews Com

How To Remove Irs Tax Penalties In 3 Easy Steps The Irs Penalty Abatement Guide Get Rid Of Tax Problems Stop Irs Collections

Get Student Loan Forgiveness If You Paid During Pandemic Pause Abc10 Com

These States Could Tax Your Student Loan Forgiveness Time

Some States May Soon Tax Students On Debt Forgiveness

Tax Debt Relief Resolve Your Debt With The Irs Bankrate

Some States Have Laws To Tax Student Loan Debt Forgiven By Biden S Plan Pbs Newshour

These 6 States May Tax Your Student Loan Forgiveness As Income Inc Com